In case you’re establishing a web based retailer with WP, then selecting between Stripe and PayPal is usually a battle. With all these complicated transaction price tables and lengthy lists of cost strategies – how are you purported to make sense of all of it?

Plus, it could actually really feel like an enormous choice if you hear scary tales about clients abandoning their carts simply because the checkout course of isn’t proper. Each misplaced sale hurts if you’re constructing a enterprise.

However we’re right here with some excellent news – you don’t need to stress about this choice!

We use each Stripe and PayPal in our personal shops, serving loads of pleased clients. This expertise has taught us precisely what every cost processor does finest.

Simply consider us as your cost processing guides!

We’ve finished all of the analysis for you – evaluating charges, testing options, and studying why clients want one platform over the opposite.

And on this information, we’ll assist you decide the proper cost resolution on your WP retailer.

Overview of Stripe vs. PayPal: Which Is Higher for Your Web site?

If you’re in a rush, then simply take a fast take a look at our comparability desk for Stripe vs. PayPal:

| 🥇 Stripe | 🥈 PayPal | |

| Finest For | Web site homeowners who want a scalable, customizable, and developer-friendly choice | Rookies who need a globally trusted and easy-to-use resolution |

| Ease of Use | Intuitive dashboard with many guides and assets | Newbie-friendly with a easy dashboard |

| Transaction Charges | 2.9% + $0.30 with some extra prices | 2.9% + $0.30 with extra prices |

| Bill & Billing Charges | A normal price of three.49% + $0.49 applies for every bill | Commonplace price of three.49% + $0.49 applies for every bill |

| International Attain | Out there in 46 nations and helps 135 currencies | Out there in 200 nations and helps 25 currencies |

| Accepted Cost Choices | Accepts credit score and debit playing cards, digital wallets, and worldwide cost strategies | Accepts funds in PayPal balances, credit score and debit playing cards, and linked financial institution accounts |

| Integration With WP | Simple integration with WP | Simple integration with WP |

| Defense | Prime-notch security measures, together with an AI-powered fraud detection system | Highly effective security measures, together with purchaser and vendor protections |

An Introduction to Stripe vs. PayPal

Stripe is an excellent versatile cost processor at the moment operating on over 1.5 million web sites.

It’s good if you wish to supply a bunch of various cost strategies to your clients. Stripe accepts bank cards, digital wallets, and recurring funds, making it an incredible choice for subscription companies or eCommerce shops.

That’s why we use it to simply accept funds on a number of of our eCommerce websites constructed with WP.

We actually love how the platform makes it straightforward to go world. Nonetheless, its excessive variety of customization choices may really feel a little bit overwhelming if you’re simply beginning out.

PayPal, however, is a family identify that clients typically really feel snug utilizing. In truth, it leads the cost processing market share (25.8%), adopted carefully by Stripe (23.4%).

We additionally supply PayPal as a cost choice on our eCommerce web sites for that reason.

The cost processor makes it straightforward to simply accept funds from bank cards and PayPal accounts.

In our opinion, PayPal’s greatest energy lies in its simplicity and ease of use. It’s an incredible alternative for anybody who desires to get began promoting on-line with out coping with too many settings.

Nonetheless, some companies may discover their transaction charges a bit excessive in comparison with different choices.

General, Stripe and PayPal each have rather a lot to supply, and each work effectively with WP, so the only option will rely in your wants.

That will help you resolve, we’ve got in contrast Stripe vs. PayPal in depth to see which one comes out on prime. Throughout our analysis and analysis, we thought of the next standards:

You should utilize the hyperlinks above to skip to any part.

📣 Why Belief WPBeginner?

At WPBeginner, we’re a crew of consultants with expertise in WP, eCommerce, Visibility, on-line advertising and marketing, webhosting, and extra.

By way of cost processors, we’ve got used each Stripe and PayPal to securely settle for funds from clients world wide.

Over time, we’ve got totally examined each platforms for ease of use, their potential to deal with world transactions, the number of cost choices they assist, and their transaction charges.

Through the use of these processors ourselves, we’ve been in a position to see firsthand how they simplify the checkout course of. To study extra, simply see our editorial course of.

Are you prepared? Let’s go!

Ease of Use

A simple-to-use cost processor can assist your online business run easily, and an intuitive platform means that you can arrange and handle funds with out technical information. That manner, you’ll be able to deal with rising your online business.

With that in thoughts, right here’s how Stripe and PayPal evaluate when it comes to ease of use.

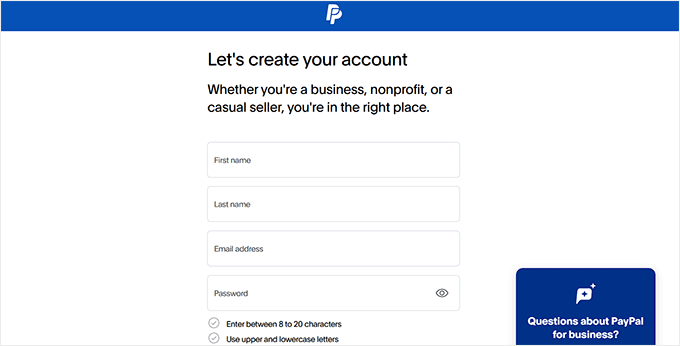

Ease of Use – PayPal

PayPal is without doubt one of the best cost processors to arrange and use, which is why it’s so widespread amongst rookies and small enterprise homeowners.

You’ll be able to create an account, hyperlink your financial institution or bank card, and begin accepting on-line funds immediately.

Plus, since most individuals are already accustomed to PayPal, your clients received’t want a lot convincing to make use of it, which can assist enhance gross sales.

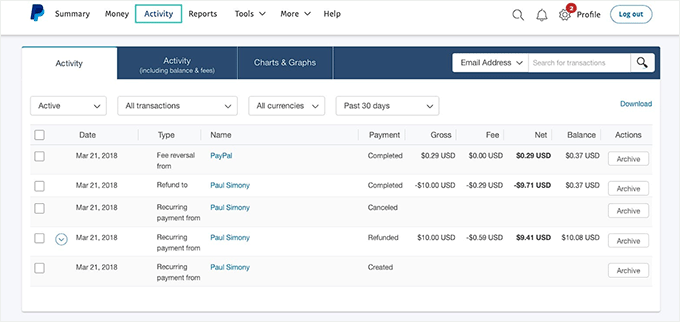

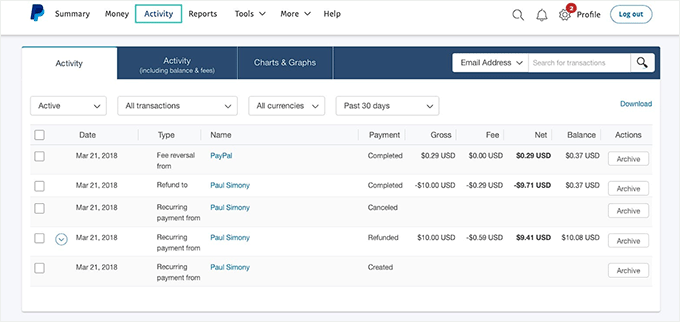

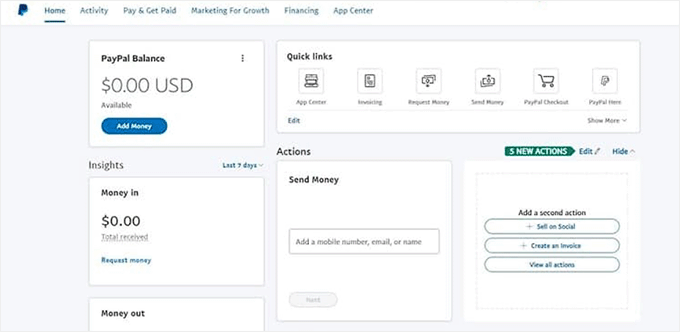

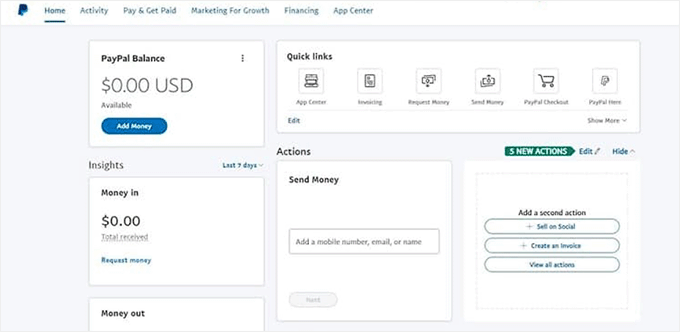

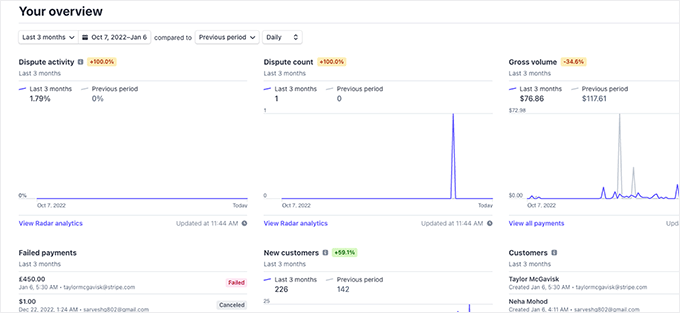

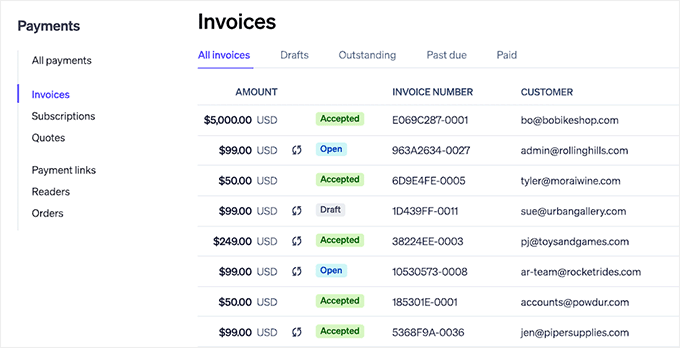

Throughout our testing, we additionally discovered PayPal’s dashboard to be tremendous user-friendly. It’s clear, easy, and simple to navigate, even if you happen to’re not tech-savvy.

From the dashboard, you’ll be able to handle all of your funds in a single place, view transactions, ship invoices, subject refunds, and even deal with disputes.

Moreover, you’ll be able to see useful insights, like a breakdown of your current gross sales and cost exercise. This makes it straightforward to maintain observe of your online business efficiency without having additional instruments.

General, PayPal is a good alternative for rookies as a result of utilizing it to simply accept funds doesn’t require any technical expertise.

Ease of Use – Stripe

Although Stripe is thought for its superior options and customizations, in our expertise, it’s surprisingly straightforward to make use of.

All it’s important to do is create an account and add your online business and banking particulars. Then, you’re prepared to begin accepting funds.

Plus, Stripe’s documentation affords loads of tutorials and guides that will help you get began.

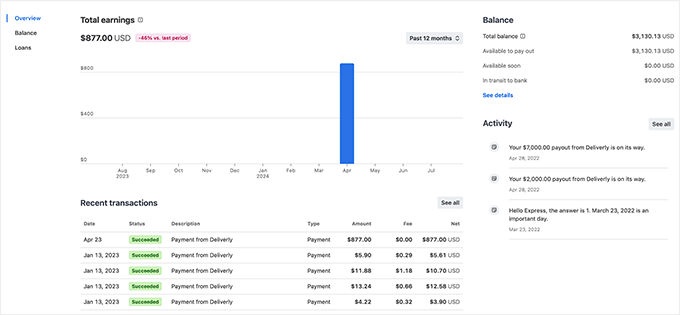

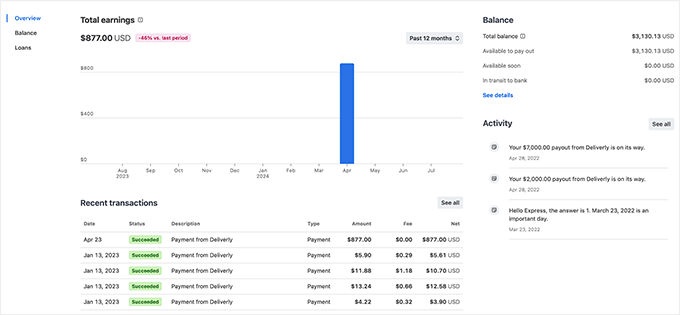

The Stripe dashboard is designed to offer you full management over your funds whereas conserving issues easy and user-friendly.

If you log in, you’ll discover a clear, fashionable interface that gives an summary of your current transactions, income, and cost tendencies.

The dashboard’s navigation is intuitive, so you’ll be able to simply discover what you want, whether or not it’s processing refunds or managing buyer subscriptions.

It additionally has detailed reporting instruments. You’ll be able to view in-depth analytics in your gross sales efficiency, observe buyer cost behaviors, and even monitor payouts to your checking account.

For subscription-based companies, the Stripe dashboard means that you can handle plans, set pricing tiers, and examine metrics like churn fee and recurring income.

You’ll be able to arrange automated electronic mail receipts, handle saved buyer cost strategies, and create customized invoices straight from the dashboard.

We additionally love its built-in instruments for detecting and stopping fraud, which add an additional layer of safety for your online business.

Whether or not you might be new to managing on-line funds or a seasoned enterprise proprietor, Stripe offers you all of the necessities, in addition to superior instruments that anybody can use.

Winner – Tie

Relating to ease of use, each PayPal and Stripe shine in their very own methods, so we’ve determined that this class is a tie.

PayPal has a simple dashboard design, which makes it tremendous beginner-friendly. You’ll be able to simply navigate by primary options like viewing transactions, sending invoices, and issuing refunds with out feeling overwhelmed.

Then again, Stripe caters to customers who’re keen to discover its highly effective options. Whereas its dashboard could appear extra complicated resulting from its superior instruments, Stripe makes up for it with detailed tutorials, guides, and FAQs.

Transaction Charges

Transaction charges might be essentially the most complicated half when selecting a cost processor. Within the subsequent part, we’ll assist make clear them for each Stripe and PayPal.

Transaction Charges – PayPal

Whereas evaluating transaction charges, we observed that PayPal is a bit on the dear aspect.

What’s extra, the platform’s charges range relying on a number of components, which suggests the price of utilizing PayPal isn’t all the time easy.

For starters, the usual home transaction price in the US is 2.9% + $0.30 per transaction. It’s the similar for retailers and people.

However this quantity can enhance if you’re coping with worldwide funds or forex conversions.

If you’re promoting to clients in different nations, then PayPal fees an extra price of round 1.5% on prime of the usual transaction fee.

Plus, if there’s any forex conversion concerned, PayPal provides a hefty conversion price, which may vary from 2.5% to 4%.

These additional fees can actually add up, particularly for companies that take care of worldwide clients.

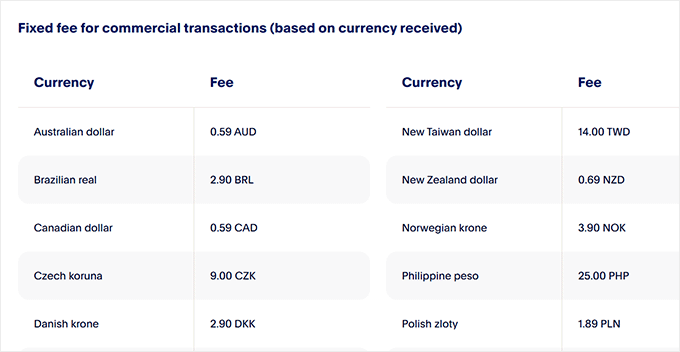

Here’s a clear breakdown of PayPal’s transaction charges that will help you see precisely what you’ll pay:

- Commonplace home transaction price (U.S.): 2.9% + $0.30 per transaction (for retailers and people)

- Worldwide funds: Further 1.5% price

- Foreign money conversions: Further 2.5% to 4% price

Now that you understand all of PayPal’s transaction charges, let’s see how Stripe compares.

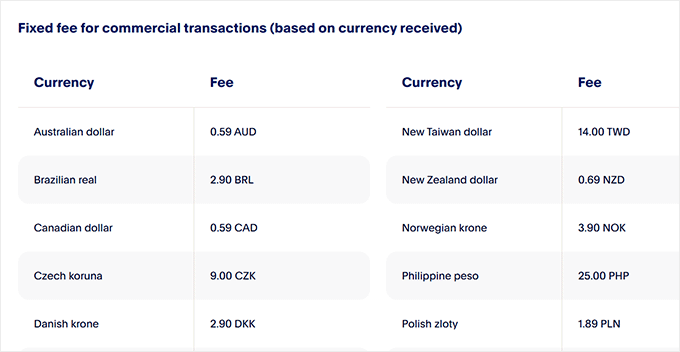

Transaction Charges – Stripe

Stripe affords the identical fee as PayPal for on-line card funds at 2.9% + $0.30 per transaction. That is the fee for retailers in addition to the private transaction price.

Nonetheless, many companies discover Stripe cheaper due to its decrease charges for forex conversions and extra cost strategies.

Not like PayPal, which provides hefty prices for worldwide transactions, forex conversion, and even refunds, Stripe has decrease charges.

Plus, it doesn’t cost setup charges, month-to-month charges, or extra charges on refunds, so that you solely pay if you course of a cost.

It is a big benefit for companies that need to broaden globally. 🌎

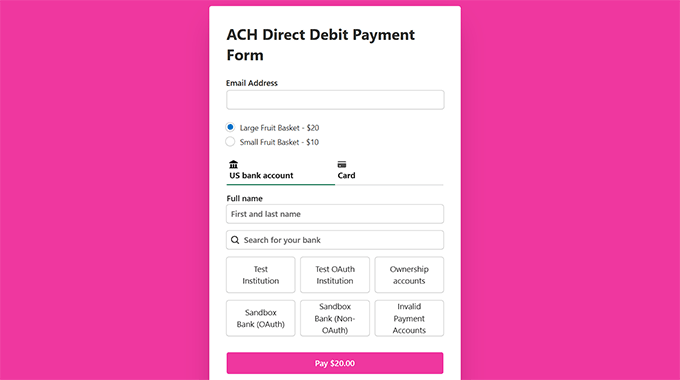

On prime of that, it helps ACH Direct Debit with a price of simply 0.8%, capped at $5, which is ideal for bigger transactions and high-ticket objects.

That stated, right here’s a clearer price breakdown for Stripe’s charges:

- On-line card funds: 2.9% + $0.30 per transaction (for retailers and people)

- Worldwide transaction price: 1.5%

- Foreign money conversions: 1%

- ACH Direct Debit: 0.8% price (capped at $5)

Winner – Stripe

Stripe is the clear winner for transaction charges. It affords a easy price of two.9% + $0.30 per transaction. On the floor, these charges look the identical as PayPal’s.

Nevertheless it fees much less for forex conversions and doesn’t cost for refunds, which makes it considerably cheaper than PayPal.

Bill & Billing Charges

The best way every cost processor handles invoicing, recurring funds, and related prices can impression your total bills. Right here’s our evaluation of Stripe vs. PayPal on this vital class:

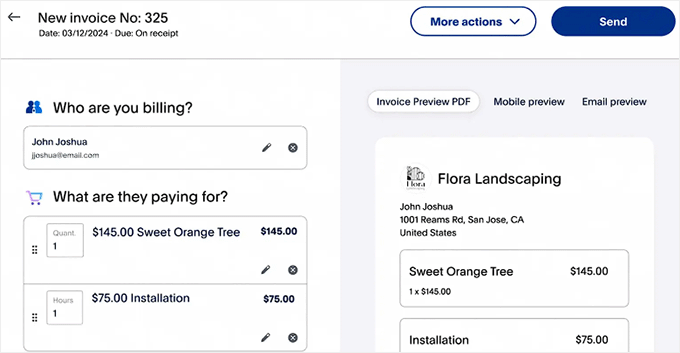

Bill & Billing Charges – PayPal

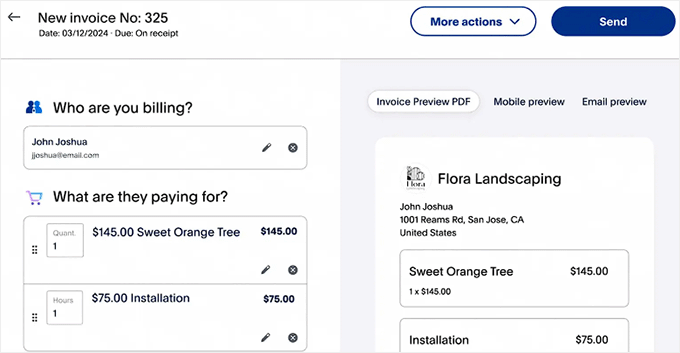

PayPal makes it straightforward to ship invoices, however there are charges to remember. Creating and sending an bill is free, however as soon as it’s paid, PayPal treats it as a industrial transaction.

For normal on-line funds by your retailer, the platform fees 2.9% + $0.30 per transaction within the U.S. Nonetheless, for invoices, the price is greater at 3.49% + $0.49 per transaction.

Whereas sending the bill doesn’t price something, you’ll pay this greater service provider price when the cost comes by.

If you’re coping with worldwide purchasers, extra charges for cross-border transactions and forex conversions could make invoicing much more costly.

That stated, one upside is that PayPayl’s invoicing software is tremendous straightforward to make use of.

You’ll be able to create skilled invoices, set due dates, and even permit partial funds, all from the dashboard.

Nonetheless, for companies that ship a excessive quantity of invoices, the transaction charges can add up shortly, making PayPal a dear choice for billing.

So, to summarize it, listed below are PayPal’s invoicing charges:

- Creating invoices: Free

- Sending invoices: 3.49% + $0.49 per transaction

- Further charges for cross-border transactions and forex conversions

Bill & Billing Charges – Stripe

Stripe Invoicing gives versatile choices with two plans: Starter and Plus.

The Starter plan consists of 25 free invoices every month, with a 0.4% price for each paid bill after that.

Then again, the Plus plan comes with extra superior options and fees 0.5% per paid bill. This makes it an incredible alternative if you would like extra management over your billing course of.

For companies managing recurring fees, Stripe Billing is a incredible function. Its normal plan affords a 0.5% price per recurring cost, with a Scale plan out there at 0.8%.

The Scale choice integrates with instruments like NetSuite and gives clients with upfront quotes earlier than subscriptions start. For prime-volume companies, Stripe additionally affords customized pricing, which can assist cut back prices additional.

Whether or not you want easy invoicing or superior subscription administration, Stripe’s pricing construction and customized pricing make it an incredible choice for environment friendly billing.

Briefly, Stripe fees:

- Starter plan: 25 free invoices/month, 0.4% price per paid bill afterward

- Plus plan: 0.5% price per paid bill

- Recurring fees: 0.5% price (Scale plan: 0.8%)

- Unique pricing for high-volume companies

Winner – Stripe

After cautious analysis, we consider that Stripe is clearly the higher choice relating to billing and invoicing charges.

With its Starter plan providing 25 free invoices per 30 days and a low 0.4% price for every paid bill afterward, it’s extra budget-friendly than PayPal, which fees a proportion of the cost plus a hard and fast price per transaction.

International Attain and Supported Currencies

A cost processor’s world attain and assist for a number of currencies could make an enormous distinction in your retailer’s success. Let’s see how PayPal and Stripe evaluate relating to worldwide availability.

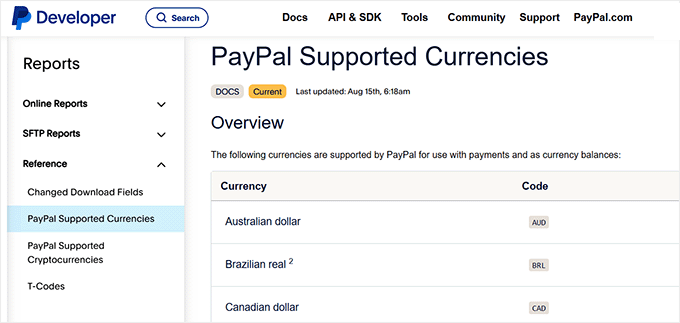

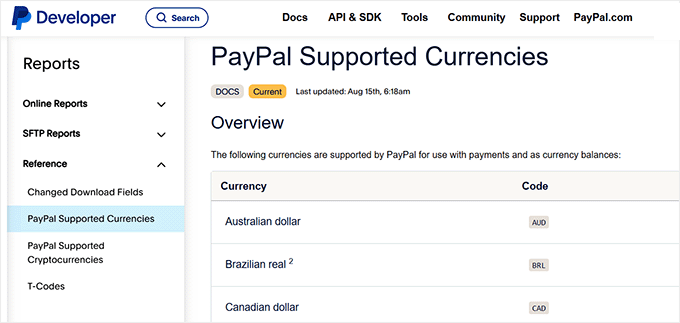

International Attain and Supported Currencies – PayPal

PayPal has spectacular world protection, making it a well-liked alternative for companies that need to attain clients worldwide.

It’s out there in over 200 nations and helps 25 currencies, making it straightforward to ship and obtain funds throughout borders.

Plus, we predict that one in all PayPal’s greatest benefits is its familiarity. Hundreds of thousands of individuals already belief and use PayPal, which may make clients extra snug finishing transactions.

Nonetheless, whereas PayPal helps many nations, its forex choices are restricted in comparison with some opponents. If your online business operates in a area with much less frequent currencies, you may face restrictions or must depend on forex conversions, which may add additional charges.

International Attain and Supported Currencies – Stripe

Stripe is one other glorious choice for companies with a worldwide viewers. It’s out there in over 46 nations and helps funds in additional than 135 currencies.

This extensive forex assist makes it simpler for companies to simply accept funds from clients world wide of their native currencies, offering a smoother checkout expertise.

What’s nice about Stripe is the way it routinely handles forex conversion. In case you promote globally, this may prevent effort and time whereas conserving issues easy on your clients.

Stripe additionally means that you can show costs in native currencies, which may construct belief and make clients extra prone to full their purchases.

For companies in supported nations, Stripe’s in depth forex choices and seamless worldwide cost instruments make it a incredible alternative for promoting to a worldwide viewers.

Winner – Tie

On this class, we’ve determined it’s a tie between PayPal and Stripe.

It’s because PayPal takes the lead in availability, working in over 200 nations, but it surely solely helps 25 currencies, limiting flexibility for companies.

Then again, Stripe helps over 135 currencies, giving companies the flexibility to simply accept funds in practically any native forex. Nonetheless, it’s only out there in 40+ nations, so its attain is extra restricted in comparison with PayPal.

In the end, the most suitable choice is determined by your online business wants. If you’re prioritizing widespread availability, PayPal is the higher alternative. But when dealing with various currencies is extra vital to you, then Stripe has the sting.

Accepted Cost Choices

Providing a wide range of cost choices is vital for assembly buyer expectations and boosting conversions. Right here’s how Stripe and PayPal evaluate on this class:

Accepted Cost Choices – PayPal

PayPal affords a stable vary of cost choices that make it a trusted alternative for companies.

Prospects pays utilizing PayPal balances, credit score and debit playing cards, and even linked financial institution accounts. It additionally helps widespread digital wallets like PayPal Credit score and Venmo (within the U.S.), which provides flexibility for purchasers.

Nonetheless, PayPal doesn’t go so far as Stripe when it comes to selection. For instance, it doesn’t assist some different cost strategies like Google Pay or Apple Pay in all areas.

This is usually a disadvantage if your online business operates the place these cost strategies are widespread.

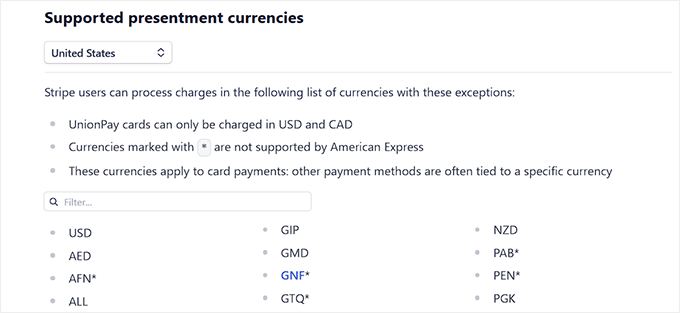

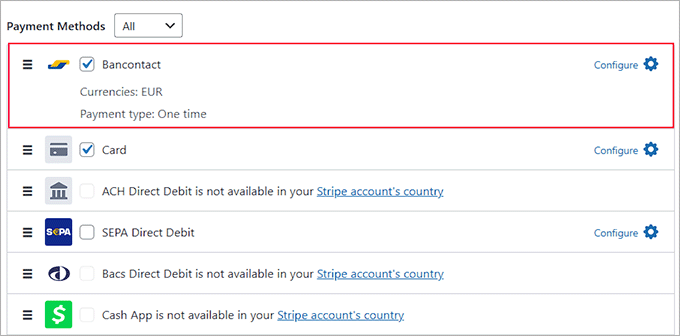

Accepted Cost Choices – Stripe

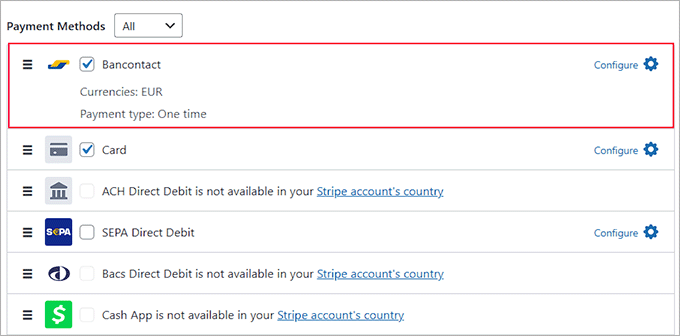

Stripe stands out relating to providing all kinds of cost choices. Along with accepting all main credit score and debit playing cards, Stripe helps digital wallets like Apple Pay, Google Pay, and Microsoft Pay.

It additionally integrates with widespread worldwide cost strategies, together with Alipay, Money App, Bancontact, and Klarna, making it best for companies that promote globally.

One among Stripe’s most spectacular options is its potential to deal with bank-based cost choices like ACH transfers, SEPA Direct Debit, and even purchase now, pay later (BNPL) companies.

This degree of flexibility permits your online business to cater to a various viewers, whether or not you favor conventional cost strategies or widespread regional choices.

Winner – Stripe

Stripe is the plain winner for cost choices.

Whereas PayPal affords the fundamentals like bank cards, PayPal Credit score, and Venmo, Stripe goes above and past with assist for Apple Pay, Google Pay, ACH transfers, BNPL, and even worldwide choices like Alipay and Klarna.

Integration With WP

If you’re deciding between Stripe and PayPal on your WP website, then seamless integration between your cost processor and web site is a should.

On this subsequent part, we’ll speak about how PayPal and Stripe evaluate relating to integrating with WP.

Integration With WP – PayPal

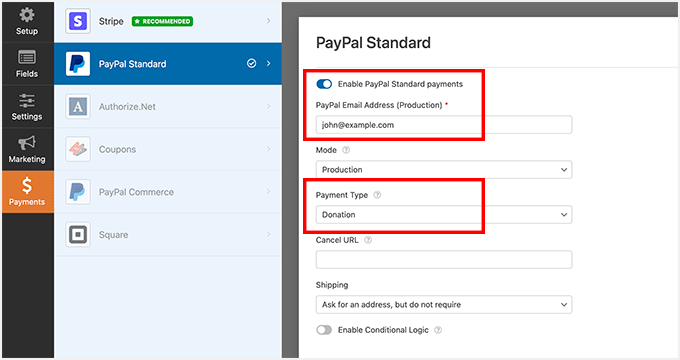

PayPal integrates simply with WP, due to its compatibility with widespread plugins like WPForms, Simple Digital Downloads, and WooCommerce.

Many of those plugins include built-in PayPal assist, permitting you to arrange cost choices shortly with none additional trouble.

For instance, WPForms permits you to add PayPal as a cost choice for donation or order varieties, whereas WooCommerce means that you can settle for PayPal funds throughout checkout.

We’ve used PayPal on our WP websites to simply accept funds, and the combination course of has all the time been clean.

Its ease of use makes it a handy alternative for WP customers who need a easy, dependable cost resolution. For particulars, see our tutorial on the way to add PayPal cost varieties in WP.

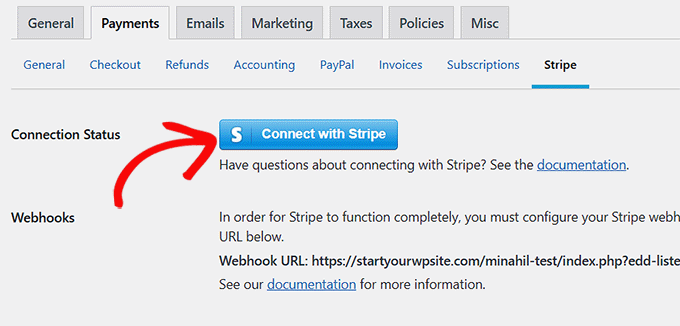

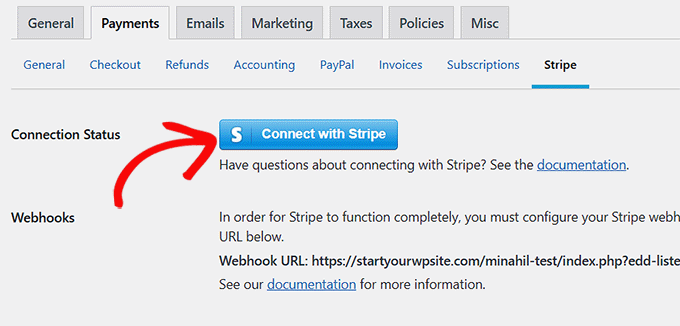

Integration With WP – Stripe

Stripe additionally integrates seamlessly with WP, which is a large plus.

It comes with built-in integration for WPForms, Simple Digital Downloads (EDD), and WooCommerce, so you’ll be able to settle for funds effortlessly.

We use EDD on a number of of our WP websites and have built-in it with Stripe. The method was fast, hassle-free, and works completely for promoting digital merchandise.

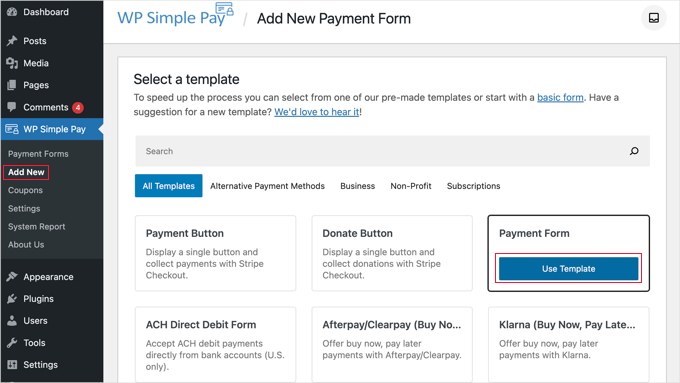

We additionally advocate trying out WP Easy Pay if you wish to settle for Stripe funds utilizing WP cost varieties.

This highly effective Stripe plugin helps you shortly create cost varieties and offers you entry to a wide range of cost choices, together with Klarna, Alipay, and SEPA Direct Debit.

This makes it a superb alternative for companies that need to supply extra cost strategies with out additional plugins or coding.

Whether or not you might be operating a small on-line retailer or a subscription service, Stripe’s compatibility with WP plugins ensures straightforward integration and a clean cost expertise.

For particulars, see our information on the way to settle for Stripe funds in WP.

Winner – Tie

PayPal and Stripe supply seamless integration with WP and its plugins.

For instance, widespread WP eCommerce options like WooCommerce, WPForms, and Simple Digital Downloads all assist PayPal and Stripe, permitting you so as to add these cost processors to your WP website with minimal setup.

Defense

Relating to dealing with funds on-line, safety is a prime precedence. You’ll want to guard your clients’ delicate data all through the transaction course of.

Now, let’s discover PayPal vs. Stripe when it comes to security measures.

Defense – PayPal

PayPal is thought for its sturdy security measures, which make it a trusted cost processor for a lot of companies. It makes use of superior encryption applied sciences, together with SSL, to guard delicate buyer information throughout transactions.

Moreover, it affords fraud safety instruments, akin to 24/7 monitoring, to detect and forestall unauthorized transactions.

PayPal’s Vendor Safety can also be fairly spectacular. It helps cowl eligible transactions in case of disputes or chargebacks. This may give you peace of thoughts, particularly when coping with worldwide clients or high-value transactions.

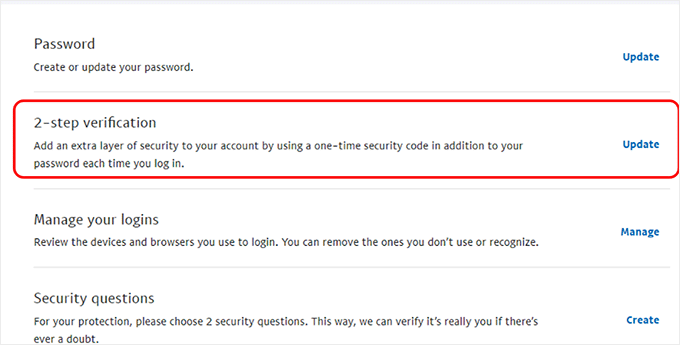

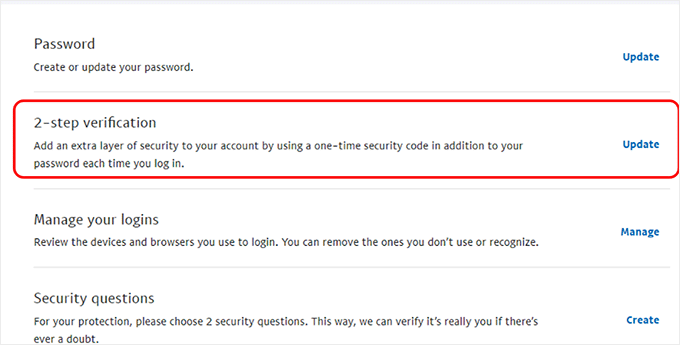

PayPal additionally helps two-factor authentication (2FA) for added account safety.

General, PayPal’s safety measures are dependable, making it a stable alternative for companies seeking to shield each themselves and their clients.

Defense – Stripe

Then again, Stripe additionally affords top-notch security measures, guaranteeing each retailers and clients are effectively protected.

It makes use of superior encryption protocols and complies with the best safety requirements, together with PCI-DSS Stage 1. Because of this delicate buyer data, like bank card particulars, is securely dealt with always.

We additionally actually like Stripe’s built-in machine studying instruments (aka laptop applications), which may spot and cease faux funds in actual time.

It additionally affords superior options like tokenization. We all know this sounds fancy (and it’s).

Nevertheless it additionally simply means it replaces delicate card particulars with safe ‘tokens’, so buyer information isn’t saved in your servers.

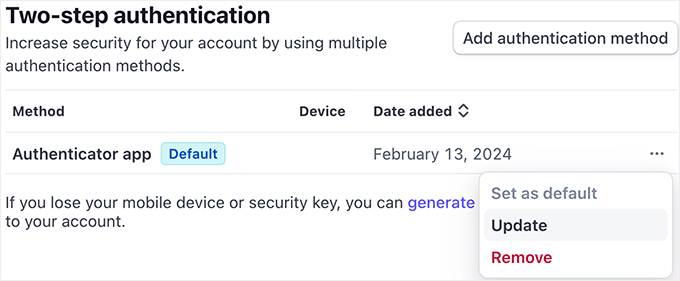

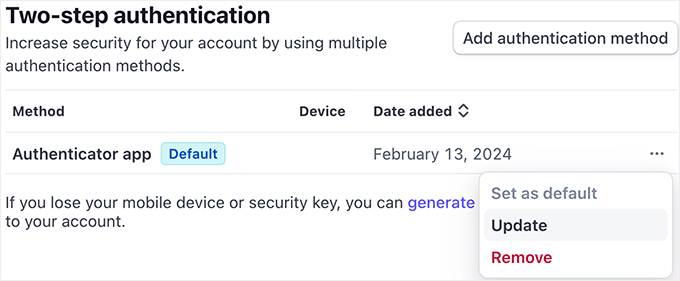

Moreover, it comes with two-factor authentication (2FA) and common safety updates to maintain your account secure from potential threats.

All in all, Stripe gives a safe atmosphere that helps shield each companies and clients from fraud and information breaches.

Winner – Tie

Each Stripe and PayPal are extremely safe cost choices, giving companies and their clients peace of thoughts. They observe strict trade requirements like PCI-DSS compliance to guard delicate cost data.

Every platform has distinctive options. PayPal affords built-in purchaser and vendor protections, that are nice for resolving disputes. In the meantime, Stripe excels with its AI-powered fraud detection system, Stripe Radar, which stops suspicious exercise.

Irrespective of which platform you select, each Stripe and PayPal prioritize safety at each step, making them trusted options for companies of all sizes.

Stripe vs. PayPal: Which Is Higher for Your WP Web site?

In our opinion, Stripe is the higher cost choice on your WP website. It affords decrease transaction charges, helps a greater diversity of cost choices, and integrates seamlessly with plugins like WP Easy Pay so as to add cost strategies akin to Klarna and SEPA.

Plus, Stripe’s highly effective security measures and detailed analytics make it a favourite for companies in search of scalability and customization.

That stated, PayPal remains to be a stable choice. It’s a nice alternative in case your viewers prefers utilizing PayPal accounts for funds, particularly because it’s widely known and trusted globally.

It’s additionally a perfect match for companies that depend on PayPal’s built-in invoicing instruments or continuously deal with dispute decision.

In the end, Stripe is right for companies in search of flexibility, decrease charges, and superior options, whereas PayPal shines for its simplicity and world familiarity.

Plus, you don’t have to only select one or the opposite. Many on-line shops supply each Stripe and PayPal funds, which is value contemplating. Providing extra cost strategies can assist you enchantment to extra clients and enhance your gross sales.

💡 Skilled Tip: Working a worldwide on-line retailer? A quick, optimized website is essential to conserving clients pleased and boosting gross sales. Our Web site Velocity Optimization Providers can assist enhance your retailer’s efficiency for buyers world wide. To study extra, see our WPBeginner Professional Providers web page.

Often Requested Questions About Stripe vs. PayPal

Listed below are some questions which are continuously requested by our readers about Stripe and PayPal.

Can I exploit each Stripe and PayPal on my WP website?

Sure, many companies use each Stripe and PayPal on their WP websites to supply clients with extra cost choices.

Each cost processors combine seamlessly with widespread eCommerce plugins, guaranteeing safe and handy transactions.

Providing a number of cost strategies also can assist cut back cart abandonment charges. If clients can’t pay utilizing their most well-liked methodology, they could go away with out finishing their buy.

By offering each Stripe and PayPal, you remove that friction and enhance conversion charges.

That’s the reason we use each Stripe and PayPal throughout a number of of our associate manufacturers, together with All in One Visibility and MonsterInsights.

Between Stripe and PayPal, which one helps extra cost choices?

Stripe helps a wider vary of cost choices, together with bank cards, ACH funds, Apple Pay, Google Pay, and even digital wallets like Alipay.

PayPal primarily helps funds by PayPal accounts and bank cards, however Stripe affords extra flexibility, particularly for world transactions.

Is PayPal higher for worldwide funds?

Whereas PayPal is on the market in over 200 nations and helps 25+ currencies, Stripe operates in 45+ nations and helps over 135 currencies.

Stripe stands out as the better option for companies with a big worldwide buyer base due to its aggressive transaction charges and world assist for various currencies.

Is Stripe or PayPal safer for dealing with funds?

Each cost processors are very safe, providing top-notch safety towards fraud.

PayPal has highly effective purchaser and vendor protections, whereas Stripe makes use of AI-powered fraud detection and tokenization to make sure safe transactions.

Both choice gives sturdy safety on your WP website, so that you don’t want to fret about buyer information breaches.

We hope this text helped you resolve whether or not Stripe or PayPal is the higher alternative on your WP website. You may additionally need to see our newbie’s information on the way to settle for deposit funds in WP and our record of vital on-line cost statistics, information, and tendencies.

In case you appreciated this text, then please subscribe to our YouTube Channel for WP video tutorials. You may also discover us on Twitter and Fb.